16+ Fha pre approval

August 16 2022. You can only get a new FHA loan if the home you consider will be your primary residence which means that it cant be an investment property or second home.

Rob Popham Big Valley Mortgage

December 30 2016 All Direct Endorsement Underwriters Effective Date.

. Or a non-FHA-approved Entity. Architectural designs permits soil tests impact fees property surveys energy reports and utility hookups. When a borrower applies for an FHA mortgage they are required to disclose all debts open lines of credit and all possible approved sources of regular income.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. The Best 15-Year Mortgage Rates for 2022. Mortgage pre-approval is an examination of a home buyers finances and lenders require five items to ensure borrowers will repay their loan.

Nothing in part 982 is intended to pre-empt operation of State and local laws that prohibit discrimination against a Section 8 voucher-holder because of status as a Section 8 voucher-holder. A year-to-year decrease lenders will want to know the cause of the drop in income before moving much further with the. This page updated and accurate as of September 16 2022 FHA Mortgage Source.

There are certain requirements borrowers must meet to qualify for an FHA loan including. Though paying a 20 down payment may not be required its still worth making a large down payment on your mortgage. For example if your gross monthly income is 5000 and your mandatory payments are 2000 your DTI ratio is 40 2000 5000.

You must occupy the property within. HUD will grant such approval only if and to the extent that the PHA has demonstrated to HUD. Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment.

Contact SCCU for car loan pre-approval before you start car shopping. Auto loan pre-approval can save you time and even money. Handbook 40001 All FHA Approved Mortgagees Issued.

If you receive a pre-approval offer from PNC you can complete and return the attached paper application through the mail. For example Fannie Mae may issue a loan approval to a client through its mortgage broker which can then be assigned to any of a number of mortgage bankers on the approved list. FHA loan requirements include a maximum debt to income ratio.

Mortgage brokers can obtain loan approvals from the largest secondary wholesale market lenders in the country. 16 A Third-Party Originator TPO is an Entity that originates FHA Mortgages for an FHA-17 approved Mortgagee acting as its sponsor. The rate of foreclosure was 116 in 2020 as reported by a recent study.

September 6 2022 - When you apply for an FHA mortgage loan your lender is required to make sure you can afford the loan and your current amount of monthly debt. For FHA loans the minimum credit score for a loan with a 35 percent down payment with a credit score minimum of 600 from most lenders. Getting a pre-approval doesnt guarantee that a lender will approve you for a mortgage either especially if your financial employment and income status change.

If youre already in this process you dont have to worry because youre still the legal owner of the house. FHA 965 35. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT WASHINGTON DC 20410-8000 ASSISTANT SECRETARY FOR HOUSING- FEDERAL HOUSING COMMISSIONER Special Attention of.

The broker will often compare rates for that day. A TPO may be an FHA-approved Mortgagee 18. The home you consider must be appraised by an FHA-approved appraiser.

Standard 20 The Mortgagee andor sponsored TPO see section IA5av SponsorSponsored Third-. Historical mortgage rate trends can give you a sense of how economic conditions influence the rates available on the market today. Whereas repeat buyers paid 16 down.

Determine your monthly gross ie pre-tax income including job earnings and benefits. The pre-foreclosure is the period between the default and sale of the property. Getting pre-approved indicates you are a good candidate for a particular card at least from the issuers perspective and have high odds of approval if you apply.

Construction loan approval documents Escrow instructions to wire funds Loan Estimate or Closing Disclosure Itemization list for pre-development costs o Pre-development cost include but are not limited to. Divide your total monthly gross income into your monthly payments to arrive at your DTI ratio. Here are several benefits to paying 20 down on your home loan.

Down Payment Requirements FHA Loan Requirements FHA Guidelines Mortgage Loan Terms Loan Approval. Ideally 620 and up. You can also apply online or over the phone at 800 282-7541.

See Below All FHA Roster Appraisers. The loan officer will be required to calculate the amount of your financial obligations and compare it to your current income to determine approval eligibility. To avoid foreclosure you can pay what you owe to your.

A minimum of 500 preferably 580. 16 Special policies concerning special housing types.

Exhibit 99 1

Louisville Kentucky First Time Home Buyer Programs And Resources Real Estate Infographic First Time Home Buyers Mortgage Loans

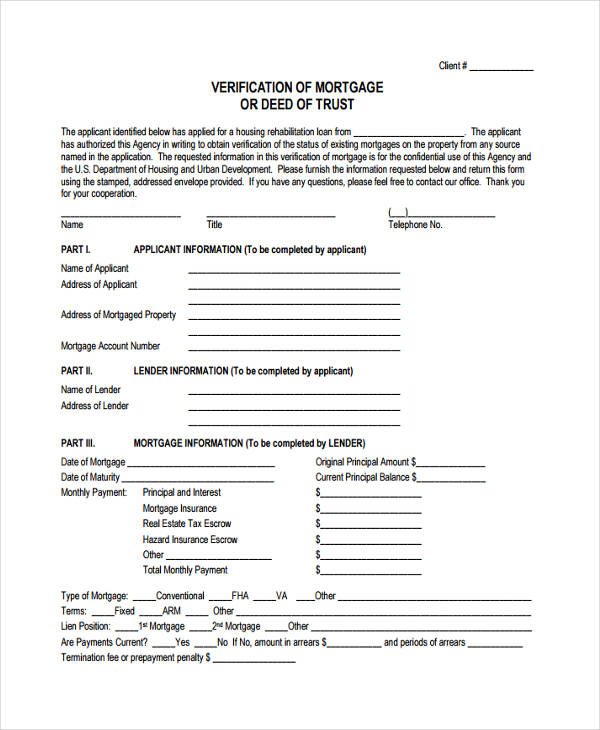

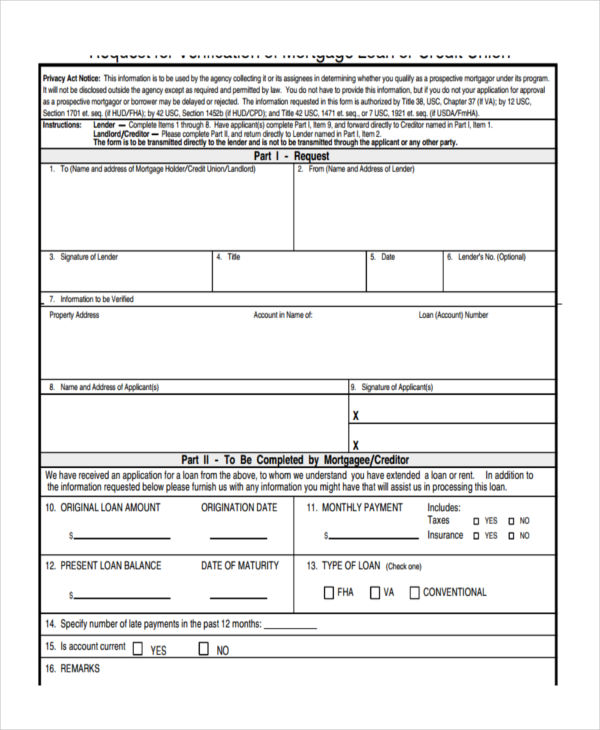

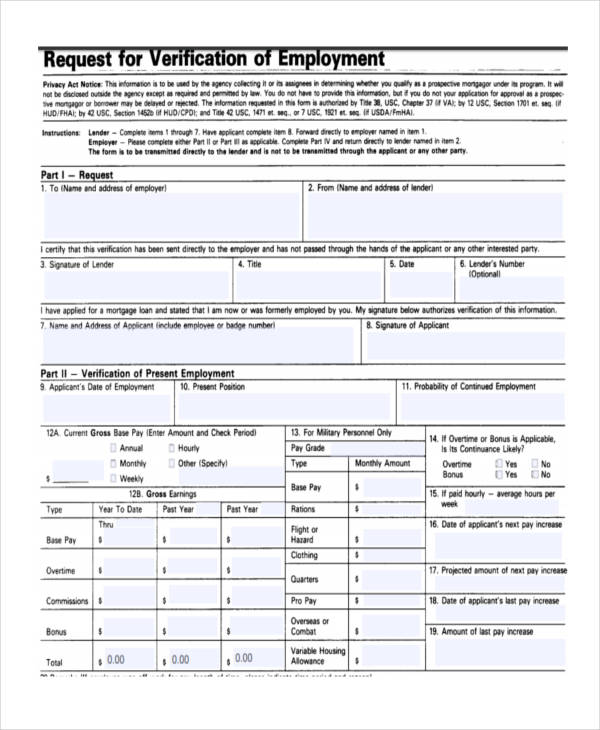

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

4 Things Every Borrower Needs To Get Approved For A Mortgage Loan In Kentucky Fha Va Khc Conventional Mortgage Loan In 2018 Mortgage Loans Preapproved Mortgage Mortgage Loan Originator

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Fha Loans Conventional Loan Mortgage Loans

Guild Mortgage Rates Review Good Financial Cents

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Same Day Mortgage Pre Approval Online With Competitive Mortgage Rates Preapproved Mortgage Business Ideas For Beginners Mortgage

Kris Cedillo Senior Loan Originator Atlantic Home Loans Linkedin

Exhibit 99 1

Sec Filing Midland States Bancorp Inc

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

Comparison Of Common Loan Programs Conventional Fha And Va Loans Closedishowweroll Academymortgage Conventional Loan Va Loan Refinance Loans

Keybank Mortgage Rates Review Mortgage Loan Options

Sec Filing Midland States Bancorp Inc